Investments

Irish Life Assurance plc

The Secret Sauce: Is There a Best Way To Invest Money?

February 28th, 2022

• 4 min read

Written by Irish Life Financial Services

It’s nice having money to invest. But with money comes responsibility: Is there a way to get the best return on your lump sum investment? Let’s walk through the factors at play.

How to make good investments

Let’s say you have €10k to invest, with the hopes of making a profit. What should a savvy investor consider when looking for investment opportunities in Ireland?

How much risk are you comfortable with?

If you're ready to invest, consider how much risk you’re willing to accept. While all types of investment have some degree of risk, some have more than others. More risk can = more rewards. But, more risk can also = higher losses.

- Would you be more likely to choose high risk for potential high-return investments, or an investment with the lowest potential loss?

- Are you cautious or adventurous when it comes to making financial decisions?

- Are you quick to react to media or market changes?

Investment risk management strategies

No matter the risk you’re willing to accept, here’s what to look for in a product. These traits will help you to take as much control as possible over your level of risk.

- Invest with a regulated company: A company regulated by the Central Bank of Ireland must always act in the best interests of consumers and comply with strict rules that help protect consumers.

- Pick multiple types of assets: Spread your risk across several types of asset classes and sectors to avoid putting all of your eggs in one basket.

- Consider volatility: Certain assets are more volatile than others. If you only invest is a single asset type (such as individual shares) you are more exposed to changes in market value for that asset type. This can demand a lot of your time to monitor the market and use your judgement as to when to sell.

- Choose a managed fund: You’ll have an expert investment manager at the lead who is knowledgeable about what assets across which sectors to mix, and who is actively monitoring performance and responding to market movements and opportunities.

Not up to date on your investment lingo? We’ve got you covered! Check out our Jargon-Busting go-to investment glossary

What does return on investment mean?

Now that you’re ready to make a smart choice that’s suited to you, let’s talk about returns.

A return on your investment is the potential amount you could gain or lose. A return can be positive when you gain money over the amount you have invested. Or a return can be negative where you lose the money you invested. It’s important to know that unless there is capital protection guaranteed, most investments are not protected and you could lose some or all of the money you invested. No one can predict what is going to happen with the market (just think of COVID!).

However, it is a good idea to leave the money you’ve invested alone for a while. We recommend at least five years, but we won’t try and convince you. We’ll let the numbers do the talking.

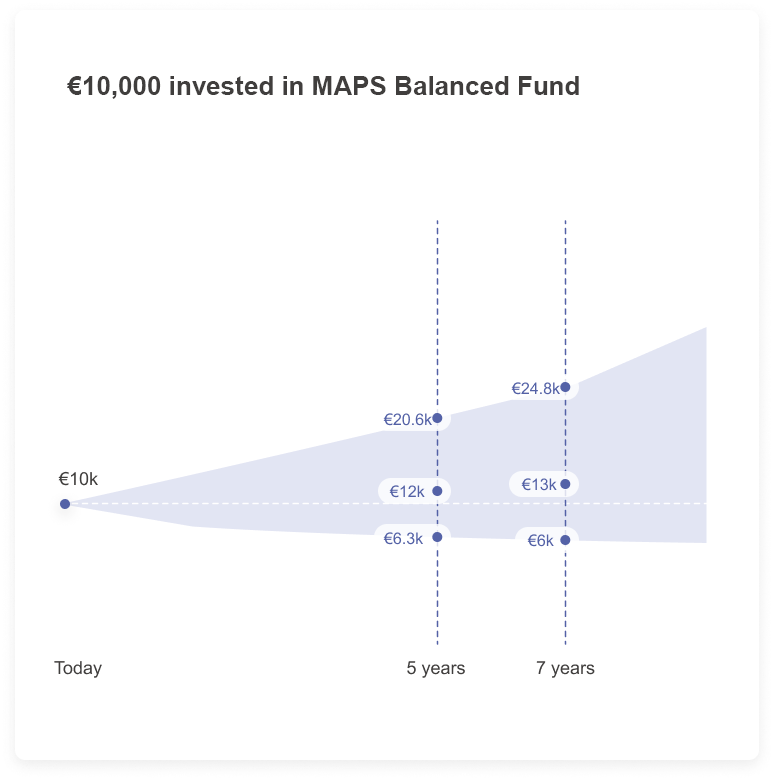

Let’s say the Smart Invest digital platform finds that your risk profile is a Balanced Risk Profile. So you use the platform to invest your €10k into the matching Multi Asset Portfolio (MAP) via a Flexinvest plan from Irish Life Assurance.

The Smart Invest digital platform is provided jointly by Irish Life Assurance, which provides the FlexInvest product, and Irish Life Financial Services, which provides the advice. FlexInvest is a lump-sum unit-linked life insurance plan which gives you access to three funds, each with different degrees of risk. You must be an 18-69 year-old tax resident of the Republic of Ireland living in the Republic of Ireland. You may not be a U.S. Citizen, a politically exposed person (PEP), or a relative or a close associate of a PEP. There is an annual fund management fee of 1.25% (Standard management fee 1.10% + an estimated average variable charge of 0.15%), a 1% Government levy is taken from any payments into the FlexInvest plan and a 41% exit tax on returns. You can invest as little as €100. You may be required to top up to keep the plan open.

Returns are calculated by Irish Life Investment managers, the appointed investment manager for Irish Life MAPS funds, before performance fees, taxes, and product charges.

Looking at an example of a €10k investment with the Balanced Investor plan over a five-year period. As we said, it’s impossible to project with 100% certainty, so keep in mind that 95% of the time the possible range of returns over the time period shown is expected to be within the range of the blue area on the graph.

This means that 5% of the time, the possible return could be higher or lower than the blue area. While this graph shows possible returns if things go badly or very well, it is more likely that your investment will see a return closer to the middle of the blue area.

So, is there really a best way to invest your money?

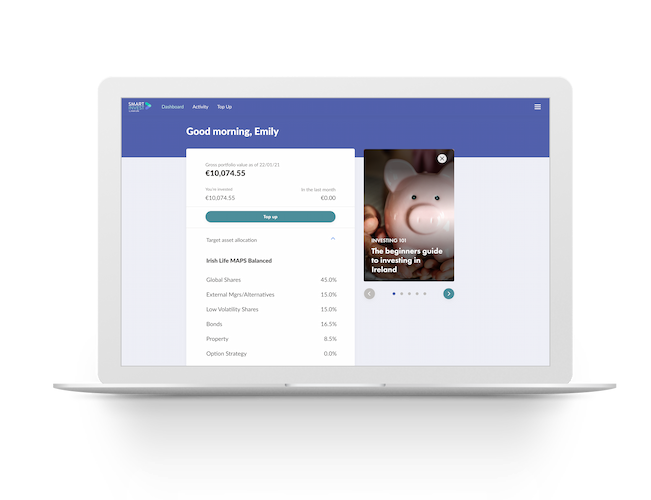

It depends on your personal situation and what you’re looking for. We always recommend that you seek financial advice. But if your needs are not complex our new digital platform, Smart Invest can make investing simple.

It’ll guide you through the steps to match you with a plan that is suitable to you based on the risk you’re comfortable with while using all of the best practices we mentioned above.

It makes investing easy for beginners to seasoned investors. We think it’s pretty great. Here’s why:

- You can invest with as little as €100

- The platform guides you through understanding the level of risk you’re comfortable with so that you can confidently invest in a plan tailored to you

- At the touch of a button (online or in the app), you can see how your investment is doing and top up as you see fit

- FlexInvest has managed funds, so our experts will do the hard bits for you

- You can see your expected range of returns (how much you could potentially lose/make) before you invest

Sign up for Smart Invest to start investing today.

For full information please read the FlexInvest Product Booklet, Terms and Conditions, and Key Information Documents.

Let's Talk

Get financial advice

Callbacks will come from Irish Life Financial Services (ILFS)

First and last name*

Phone number*

Pick a time slot

Your personal details will only be used to deal with your request. See the ILFS privacy notice for your rights and how your information is used.

Irish Life Financial Services Limited is tied to Irish Life Assurance plc for life and pensions. Irish Life Financial Services Limited is regulated by the Central Bank of Ireland.

Have a question?

Arrange a time that suits you to speak with a qualified Financial Advisor about your financial planning needs

Financial Advice Opening Hours

Mon - Thur: 9am to 5pm

Fri: 9am to 4pm