News

Irish Life Financial Services Limited

Yearly Budgeting – How to Plan for the Year Ahead

November 21st, 2022

• 6 min read

Written by Irish Life Financial Services

Planning a wedding, buying a house, sending your little ones to daycare – there are some big expenses that you can expect and prepare for. At the same time, an emergency dental visit or your car breaking down can catch you off guard and put a strain on your finances. That’s when having a yearly budget can come in handy.

While tracking expenses and planning long-term might sound stressful, it doesn't have to be. Knowing exactly how much money you have left after your regular expenses and savings contributions can be liberating and give you much-needed peace of mind.

Here are some practical tips on how to plan your yearly budget to help you get started.

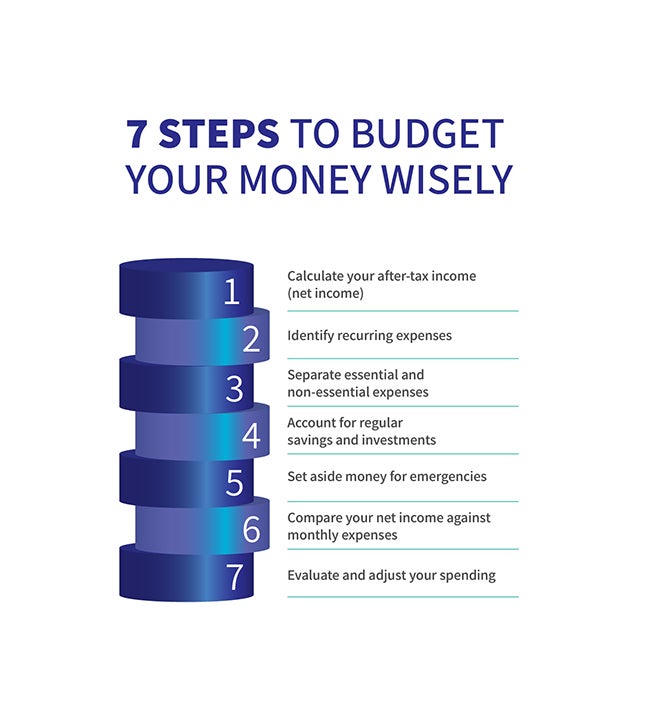

How to budget your money wisely

A national 2022 PayPal survey conducted by Censuswide revealed that 59% of Irish people are extremely worried about the cost of living crisis. Creating a budget that helps you track expenses and outline your spending allowance can help to alleviate some of that anxiety and put you back in control of your finances. In fact, the same research showed that over half of the survey respondents plan to do just that.

To start, take stock of your net income versus your expenses. Have a look at any gathered receipts, online bank statements and transactions for any money-transferring apps that you might be using. Once you identify your regular expenses, you can start outlining your monthly budget. Identify your net income (the amount of money that actually reaches your bank account), set some money aside for unexpected expenses, and account for your regular savings. To make things easier, use this step-by-step budgeting sheet.

How to plan this year's budget

While planning a year ahead might seem challenging, once you have a solid system and a yearly budget planner in place, it should become easier and turn into one of your smartest financial habits. To create a rough annual budget, you can start by calculating your monthly budget and then multiplying it by 12. However, remember to account for additional yearly expenses like Christmas and birthday presents, tax payments, car insurance and other annual costs.

To create a thorough yearly budget, consider applying some of the tested tips below.

Using the 50/30/20 budgeting rule

The 50/30/20 budgeting rule suggests you allocate 50% of your income to things you need, spend 30% on things you want and put the remaining 20% into savings or investments. This principle helps you plan ahead and manage your money smartly by encouraging you to separate your needs from your wants and determine your spending priorities.

Be honest with yourself and try to accurately evaluate your day-to-day spending. By honing in on potential areas of concern, you can spot opportunities to save money and help to improve your financial wellbeing.

To evaluate your needs, first, consider your essentials and expenses that must be covered each month. While needs might differ from person to person, there are some constants like food, rent or mortgage, utility bills, GP visits, everyday travel expenses and so on.

Wants are your ‘nice to haves’ – something you would like to spend money on as part of this year’s budget rather than must-haves. These can include nights out with your friends or family, cinema trips, buying new clothes or getting the latest gadgets. Note that what one person qualifies as ‘needs,’ another person may consider an optional ‘want.’ It’s important that you clearly differentiate between the two, so you can identify the best money-saving opportunities for you.

Create an emergency fund

The 50/30/20 rule suggests that you put 20% of your income towards your emergency fund if you don’t have one set up already. Even with the most thorough planning, it’s nearly impossible to account for all the possibilities.

Regularly putting some of your income away for a rainy day can help create a comfortable buffer and make handling unexpected expenses, like medical emergencies or a job loss, less stressful. If you’re ahead of the curve and already have an emergency fund in place, you could consider investing that 20% instead.

As a rule of thumb, it’s a good idea to have an average of three months’ salary in your emergency fund. However, it’s fine to start small and put away as much as you feel comfortable with. Once you start doing it regularly, it can become a useful financial habit and help you handle whatever life throws at you.

Factor in your retirement savings

While retirement may seem far away, it’s wise to start saving early to help you properly enjoy your golden years. Consider adding a pension contribution as a regular expense in your monthly and yearly budgets so when the time comes, you might afford to cross off a few fun things on your bucket list.

To determine how much you should save for retirement, consider your potential future needs and wants, as they will likely differ from your current ones. Expenses like childcare and mortgage payments might become obsolete or less prevalent. In contrast, medical expenses are likely to go up.

Also, don’t forget to factor in pleasant expenses, like picking up a new hobby or embarking on that luxurious cruise you’ve always dreamed about. Considering the current state pension for Irish citizens is approximately €13,000 per year, a personal pension fund can be a key strategic move to potentially ensure a more comfortable retirement.

Stay consistent with your yearly budget

Once you have a defined yearly budget in place, it might be tempting to adjust it as you go. However, the very purpose of a budget is to help you stay on track and work with the income that you have. After all, you have put a significant amount of work and effort into creating the budget and carefully considered your regular and potential expenses – it only makes sense to follow your own roadmap.

You can consider tweaking your yearly budget for events that significantly impact your financial circumstances, like a pay raise or an unexpected move. But being consistent will make it easier for you to review your budget, take note of any issues, and adjust it for the following year.

Review your yearly budget

To help you stay on track and spend smartly, regularly review your actual expenses and compare them to the estimated ones. Take note of your bank balance at the end of the month and review any unexpected expenses or underestimated costs.

Did your food spending exceed your allocated allowance? Try shopping at a cheaper supermarket, signing up for a customer loyalty scheme in-store or buying items in bulk. Was your electricity bill more expensive than you expected? Consider some energy-saving techniques like scheduling your washing machine or dishwasher to run overnight to make the best use of the cheaper night tariff.

By reviewing your adherence to the yearly budget, you can spot any negative trends early, adjust your spending and ensure you stay on track with your finances. Don't forget to review your budget at the end of the year and, if possible, compare it to the year before. This will allow you to see changes in your spending and plan more accurately for the year ahead.

When to create a yearly budget

As with most financial planning, the earlier you start, the better. When it comes to drafting a yearly budget, the golden rule is to start planning for the following year before the end of the current one. This way, you’ll know exactly where you stand financially and how much you can afford to spend without putting a strain on your budget so that you can start the year without stress or financial anxiety.

While Irish Life Financial Services don’t provide advice on budgeting, we hope you found this article useful. We do though recommend that you get a financial review. You can get a free financial review online now to take the first steps towards taking control of your finances.

Alternatively, to discuss your financial goals, book an appointment with a financial adviser below to get expert advice on protection, retirement and savings needs.

Relevant articles

Clever Ways To Save Money for Kids

How To Manage Inflation and Help Protect Your Finances

How Much Money Should I Save for Retirement?

Spend Smarter and Save More – How To Budget Your Money Monthly

How to Budget Using the 50/30/20 Rule

Are you sticking to your New Year’s financial resolutions? We show you how!

Smart financial habits worth starting today

Let's Talk

Get financial advice

Callbacks will come from Irish Life Financial Services (ILFS)

First and last name*

Phone number*

Pick a time slot

Your personal details will only be used to deal with your request. See the ILFS privacy notice for your rights and how your information is used.

Irish Life Financial Services Limited is tied to Irish Life Assurance plc for life and pensions. Irish Life Financial Services Limited is regulated by the Central Bank of Ireland.

Have a question?

Arrange a time that suits you to speak with a qualified Financial Advisor about your financial planning needs

Financial Advice Opening Hours

Mon - Thur: 9am to 5pm

Fri: 9am to 4pm