Financial wellbeing

Irish Life Assurance plc

How to Budget Using the 50/30/20 Rule

January 1st, 2025

• 7 min read

Written by Irish Life Assurance

Budgeting your money shouldn’t be complicated, and you absolutely don’t need to spend hours wrecking your head over it. You’ve put in the work, you’ve earned the money, and you don’t want to stress thinking about where it’s all going to go.

That’s where the 50/30/20 rule comes in. It’s a simple principle to develop good financial habits and budget your money with minimal hassle.

Once you’ve got a handle on your day-to-day finances and budgeting, you can take steps towards improving your financial future with things like pensions, protection, and investments.

You can get a free financial review to discuss all of this with an advisor whenever you like.

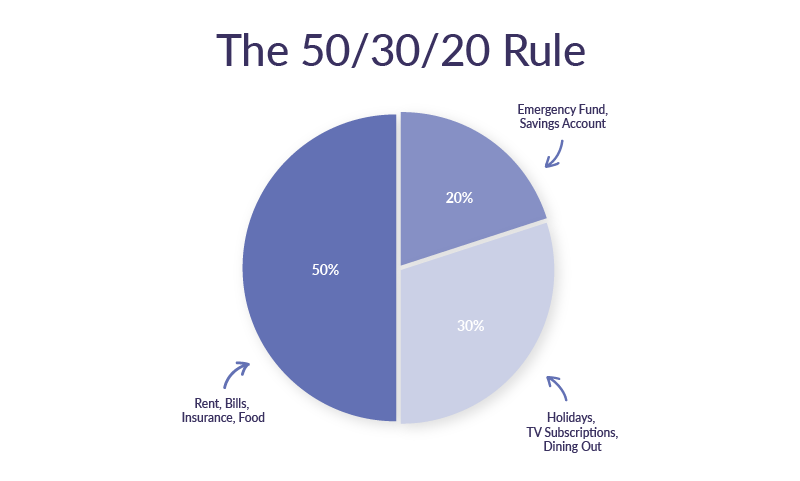

Alright, so what is the 50/30/20 rule?

It’s a simple way to divide your money each week or month (whenever you get paid, basically) to make sure that you’re not overspending or underspending in any important areas. In a nutshell:

- 50% of your income gets spent on your needs. This is your rent or mortgage, your groceries, bills, and other essentials.

- 30% of your income goes towards your wants. This is what you spend on your lunches with friends, trips to the cinema, or a night out on the town.

- 20% of your income goes towards your savings. If you can afford to save 20% of your income as a non-negotiable, you’ll have quite a nest egg built up faster than you imagine.

What if I can’t afford 50/30/20?

The 50/30/20 rule is a general guideline, not a hard and fast rule.

Of course, there are plenty of people for whom the essentials are way more than 50% of their take-home income.

While there are some steps you can take to reduce your monthly costs (read on for some hints!) the reality is that the cost of living is increasing faster than wages.

If your essentials are coming to 70% of your income, it doesn’t mean you can’t budget. Maybe a “70/20/10” rule is a better option for you. If that feels too miserable, try “70/25/5” instead.

Anything you can do to better your financial situation is worth doing, even if it seems like throwing a deckchair off the Titanic.

How to implement the 50/30/20 budgeting rule

Before you even start to crunch the numbers, it’s a good idea to begin with the actual, practical aspects of sticking to this rule.

Is your salary coming into the same account you’re using to pay your essentials as well as spend on your social life, and you’re trying to keep a little of it aside each month to save?

Well, then you’re doing financial health on hard mode. With the best will in the world, that’s a recipe for disaster.

To adhere properly to the 50/30/20 rule and get yourself truly financially disciplined, you might look to have three bank accounts:

- Account A: this should be the account that all your essential bills come from – both direct debits for rents and phone bills and the like, as well as any spend on groceries and other things you need.

- Account B: this can be another current account, but ideally it should be a dedicated savings account. You should be able to access it, but it would be good for self-discipline if it was an online saver or another account you can’t spend from directly.

- Account C: this is your “fun account” that you can use for anything you want – social hangouts, trips away, fancy dinners, or nice little outfits. It’s up to you!

It doesn’t matter which account you get paid into, but each payday you should make sure that Account A has enough to cover your bills and essentials, Account B has a top-up for your savings, and Account C is whatever you have left for fun.

Oh, and these days most banks will let you open a new single-person account online with very little hassle, so there’s no excuse!

Budgeting your needs: the 50

The 50/30/20 rule starts with the percentage of your income that you spend on your needs.

These are your essentials: your rent or mortgage, your groceries, your utility bills, the cost of commuting… basically, it’s the things you need to survive and keep the money coming in!

And remember – even though your essentials might be more or less than 50% of your income, the same principles apply.

What counts as an “essential”?

This can be a little subjective from person to person, but in general if it’s something you absolutely need then it counts as part of the 50%.

When it comes to managing your budget, be realistic and ruthless about what you actually do need – not just what you want or prefer.

Obviously your rent or mortgage falls into the “need” category – and it’s probably the biggest expense in your 50% by quite a long way! Your utility bills are also part of this, as well as your grocery costs.

After that, it becomes a little more personal: some of us absolutely need to drive to work, so car insurance and petrol and parking are essentials. Others simply prefer to drive, and could potentially save money by getting the bus or cycling.

If you’re serious about safeguarding your financial future, then your pension contributions (if they’re not taken from your salary automatically) and any protection policies like life insurance or illness cover should also fall into this category.

Reducing your essential costs

If you’ve got your non-negotiable list of needs and you still think the cost is a little high, you can look at reducing each individual expense. A few simple things you can do include:

- Planning your meals and having a shopping list to reduce your food bill.

- Switching your utility providers regularly to take advantage of new customer offers.

- Making sure you’re using all your employer benefits and perks.

If you’ve minimised your regular costs and they’re still above 50%, just adjust the other areas to add up to 100%. Remember, this is a guiding principle and not a hard and fast formula to follow.

Truly disposable income: the 30

This area is for your “nice to have” things rather than the “must have” parts of your life.

These are the lunches out with friends, trips to the cinema, new outfits, and the latest model of phone.

One of the toughest things about the 50/30/20 rule is determining what is a need and what is a want – but if you have a clear distinction, it’s a great way to save money and feel more financially secure.

Keep an eye on your account

Whether you have a separate account for the 30% or not, it’s important to know how much you’ve got left and how long it has to last you.

These days, there’s no excuse – you can get your bank balance on your phone immediately, so be sure to keep track of your cash. Remember, you can’t borrow from the 50% to get an extra dinner out or go to that gig – you need that money for, well... your needs!

Get rid of what you don’t use

Checking your balance regularly is also a good opportunity go through your bank statements and look for recurring monthly expenses. See how much that underused gym membership is costing and remind yourself how much all those streaming services add up to – could that money be better used elsewhere?

Money left over?

It’s a nice problem to have if you find you naturally spend less than 20% of your income on your wants.

In this case, you could try swapping things around – try covering all your wants with 20% of your income and putting 30% into savings instead.

Savings, investments, and even early retirement: the 20

If you’re following the 50/30/20 rule, then 20% of your income is titled simply “savings.”

But what are you saving for?

You can think of this part of your budget as simply being money for “future you” if you don’t have a specific savings goal.

That said, the first thing you should do with your 20% is to create an emergency fund.

What is an emergency fund?

It’s exactly what it sounds like. People have rainy day funds, but this is more like a monsoon fund – something for an unforeseen disaster.

Unexpected costs are part and parcel of life. Maybe your car gets a puncture, maybe your boiler gives up the ghost, or maybe you’re made redundant. Having an emergency fund is a way to account for the sudden expenses that take you by surprise.

How much should be in your emergency fund?

As a general rule of thumb, having at least three months’ essential costs covered in your emergency fund is a good idea.

This might not be possible for everyone right away, so you could start with a smaller amount, give yourself a pat on the back for adulting, and then keep building on it – every little helps, and it builds up quickly.

You may even see recommendations for having three to six months’ of total income in an emergency fund, and depending on your circumstances (i.e. if you’re self-employed) then it might be an idea to have more saved rather than less.

If you have to use the emergency fund, then don’t feel bad about it. Sticking to the 50/30/20 rule will help you top it back up in no time. You’ve put a lot of effort into creating financial security in your life, so use it when you need it.

You can also use one-off payments to help top up your emergency fund. Did you get an unexpected tax refund, a sweet little bonus at work, or come into some inheritance? Move it to your emergency fund and future you will be grateful!

I’ve got an emergency fund – now what?

Once you have your emergency fund set up, that’s not an excuse to stop putting 20% aside.

What you do with your 20% now depends on your personal goals. Some ideas could be:

- Save for a goal or a purchase, like a house deposit.

- Invest the money to try and boost your net worth.

- Make additional contributions to your pension.

- Look at protection policies to safeguard your income.

If you have a handle on your budget and an emergency fund in place, then you’re in the perfect position to speak to a financial advisor. They can help you make an informed decision about what to do with your excess savings and help to set you up for a healthier financial future.

Please note: Irish Life financial advisors do not advise on day-to-day budgeting and saving. However, if you wish to have a free, confidential call about protection policies, pensions, and investments then please contact us via the form below.

Let's Talk

Get financial advice

Callbacks will come from Irish Life Financial Services (ILFS)

First and last name*

Phone number*

Pick a time slot

Your personal details will only be used to deal with your request. See the ILFS privacy notice for your rights and how your information is used.

Irish Life Financial Services Limited is tied to Irish Life Assurance plc for life and pensions. Irish Life Financial Services Limited is regulated by the Central Bank of Ireland.

Have a question?

Arrange a time that suits you to speak with a qualified Financial Advisor about your financial planning needs

Financial Advice Opening Hours

Mon - Thur: 9am to 5pm

Fri: 9am to 4pm