Financial wellbeing

Irish Life Financial Services Limited

Financial Literacy Resolutions for 2024

December 14th, 2023

• 6 min read

Written by Irish Life Financial Services

When you think of New Year’s Resolutions, you probably think of losing weight, taking up new hobbies, or giving up smoking. But did you know that “get better with money” is one of the top five most popular New Year’s resolutions in Ireland?

Financial literacy is a foreign concept to a lot of people, but it’s one of the biggest steps you can take to improve your quality of life – and you can start today.

What does financial literacy mean?

All that financial literacy means is the ability to understand and manage your finances. At a basic level, it means being able to budget, live within your means, and make sensible decisions regarding your money. Being financially literate empowers you to make better life decisions and plan for the future. In short, it’s a resolution well worth making!

Financial literacy begins with your household budget

Most people want to get better with money in order to live better lives. That doesn’t mean private jets and gold watches, but simply being able to reduce stress and anxiety around money both now and in the future. That means the best place to start is with your day-to-day finances and household budget.

Assess your income and spending

You don’t need to be an economics graduate to realise that if you’re spending more than you’re earning, that’s bad news for your financial health.

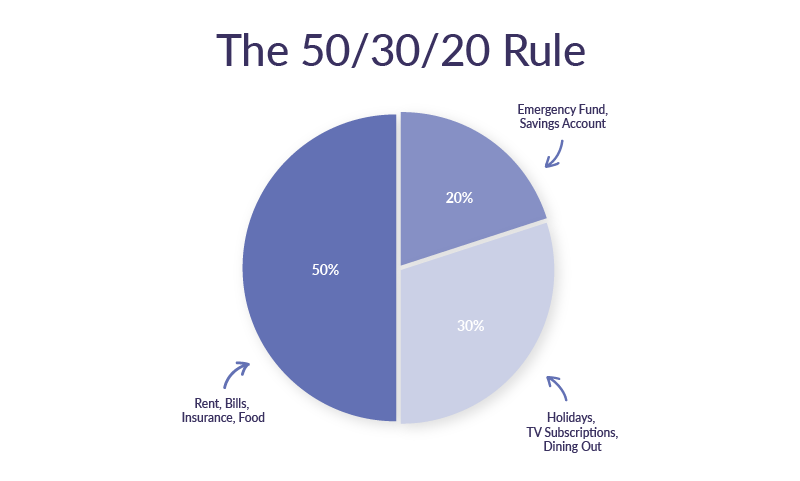

Following a budgeting system such as the 50/30/20 rule can be a great way to make sure you control your spending and live within your means, while still being able to enjoy yourself and plan for the future.

Pay off your debts methodically

William Shakespeare wrote “neither a borrower nor a lender be.” Now, William might not have been a financial advisor but he’s not far off the mark here: if you do have any debts, it’s well worth getting a handle on them. If you have multiple debts, then you definitely need to prioritise them and pay them off in a way that makes the most financial sense.

Your highest-interest debts such as credit card bills should be paid off first, even if they’re smaller debts. A smaller debt with a higher interest rate could easily cost more in the long run than a larger debt with a low rate.

If you pay off your highest-interest loans first, you will be charged less for your loans in the long run. Make sure you’re still keeping up the minimum regular payments on your other loans as well, though!

Once the highest interest debt is paid in full, use the excess money to overpay on the next highest debt, and continue to do this until you’re debt-free. A big part of financial literacy is being able to prioritise and track your debts and remain on top of them.

Maximise your income tax relief

No, we’re not talking about banking in the Caymen Islands or giving a dodgy accountant your Revenue login. There are several legitimate and legal ways to claim back income tax you paid during the year, or even to pay less in the first place.

Start a pension (or increase your contributions)

We’ve said this before (more than once) but it really bears repeating. The best time to start your pension was the moment you began working. The second-best time is right this very minute.

At the time of writing, the maximum Irish State Pension is less than €14,000 of income per year. Anything you put into a private pension now is extra income you will have in retirement. Tools like a pension calculator can help you to figure out how much you need to save to be comfortable when you stop working.

Alright, so maybe you already have a pension in place. Are you making the most of it? Depending on your age and income, you could be missing out on significant income tax savings by not making a higher pension contribution.

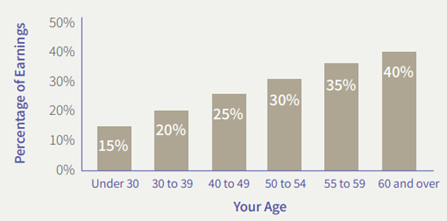

If eligible, you can get income tax relief at your highest rate of tax on pension contributions up to a maximum figure that increases as you get older. For example, a 32-year-old can put up to 20% of their annual income into a pension, while a 51-year-old has a limit of 30%.

These contributions are not subject to income tax. If you are a taxpayer in the 40% bracket, every €100 you pay in will effectively cost you just €60. That means it’s well worth making the maximum contribution for your age – if you can afford to do so.

Claim back medical expenses

If your medical expenses aren’t already covered by the state or by private health insurance, you can claim back 20% at the end of the tax year. Nothing says “financial literacy” like paying less for the same service.

Claiming your medical expenses is a straightforward and simple process. Visits to any medical professional, including therapists and acupuncturists, are included under the scheme. Even non-essential medical procedures such as IVF and laser eye surgery can be claimed for, and non-routine dental procedures are also eligible.

Build an emergency fund

Rainy days are all well and good, but what if there’s a monsoon?

The rainy day fund isn’t a new concept, but it’s being rapidly displaced by the far more sensible emergency fund. The idea of an emergency fund is a fallback that allows you to weather a major storm, not just a spot of drizzle.

It’s not inconceivable that in a short period of time, you could lose your job, your car’s head gasket could blow, and the boiler could flood the house. Periods of bad luck do happen, and having a robust emergency fund means you have one less thing to worry about when nothing seems to be going your way.

In fact, financial advisors would recommend having three months’ gross salary in your emergency fund if at all possible. That means that if you earn €48,000 a year, your emergency fund should be €12,000.

If that’s not practical for you at this point, you should definitely look put aside whatever you can as you work towards this figure. Anything that can be kept for an emergency will help out when the time comes, and you can continue to build the fund up over time. Rome wasn’t built in a day, after all!

Invest your excess income

If you’re fortunate enough to have both an emergency fund and money left over once you have paid your household bills and essentials, consider investing. It might seem an intimidating prospect, but it’s quite straightforward – and it’s definitely not just an activity for super rich Wall Street types.

Naturally, investing does carry risk: the value of your investment can go down as well as up, and you could lose some or all of your money. However, if you are in a position to invest (i.e., you have your financial ducks in a row because you read a great article about financial literacy) you could very well be better off strategically and regularly investing than simply keeping your money in a bank.

Kept in a bank, your money will barely grow at all (and in fact, thanks to inflation, might end up being worth less!) When your money is invested, it has a chance to grow. This is especially true if you’re willing to invest over a longer period, which can help to mitigate some of the short-term risk involved in investing.

Need any help?

So, you want to make this the year where you get your money in order and get on top of your finances. You’re in luck: did you know that Irish Life offers a free financial advice service?

While we cannot advise you on day-to-day budgeting, our experts can help you with pensions, investments, and protection. Once you’re ready to take the next step to financial health, fill out the contact form below to arrange an appointment with a qualified financial advisor to discuss your situation and begin your journey to financial literacy.

Let's Talk

Get financial advice

Callbacks will come from Irish Life Financial Services (ILFS)

First and last name*

Phone number*

Pick a time slot

Your personal details will only be used to deal with your request. See the ILFS privacy notice for your rights and how your information is used.

Irish Life Financial Services Limited is tied to Irish Life Assurance plc for life and pensions. Irish Life Financial Services Limited is regulated by the Central Bank of Ireland.

Have a question?

Arrange a time that suits you to speak with a qualified Financial Advisor about your financial planning needs

Financial Advice Opening Hours

Mon - Thur: 9am to 5pm

Fri: 9am to 4pm