If the idea of using compound growth to reach your financial goals appeals, then our advisors are on hand to help you.

Book an appointment virtually or in-person at a time to suit you.

by Irish Life

Written by Irish Life staff

Guides • 26 March 2025 • 5 min read

• What compound growth is and why it’s so important.

• How frequency and rate impacts compound growth.

• How to make the most of compound growth in investing.

Compound growth is one of the most powerful financial forces in the world, and it’s especially important when it comes to investing.

Essentially, compound growth means that you generate returns on both your original investment as well as on any previous returns. That second part is extremely important.

Imagine you have a choice between one of two gifts:

It’s tough to turn down a million Euros with €50,000 a day on top. At the end of the 30 days, choosing €1m will give you a grand total of €3,500,000 in the bank. Not bad.

Compound growth can lead to huge returns.

But now consider the power of compound growth.

Unlike simple interest (where you only earn interest on your original money, like in the first gift), compound interest lets you earn interest on your interest.

This snowball effect can have stunning results. In fact, you're going to wish you had chosen the €0.01 bank balance.

Had you chosen that doubling €0.01, you’d be looking at a final figure of €5,368,709.12 – nearly a full €2,000,000 more than the €1m and daily top-ups.

“Compound growth is one of the most powerful financial forces in the world.”

There is a formula to calculate compound growth: P(1+r/n)^(nt) where P is the starting amount, r is annual growth rate, n is interest frequency, and t is the number of years the investment is held.

But that’s pretty convoluted and a bit too much like hard work, so let’s just work with the Rule of 72.

The Rule of 72 basically tells you roughly how long it would take to double your money. Take the number 72 and divide it by the estimated growth rate – that’s how long doubling your money takes.

So at 6% interest, your money will double in 12 years (72/6 = 12). Easy.

Of course, the nature of investments means that you can’t predict annual growth. Even if you do get a 6% average growth rate over 12 years, it’s not going to be smooth and linear; there could be some 20% years and some -15% years, all averaging out to 6% annually.

That’s why it’s so important to remember that investing is a long-term game of patience. It’s not a get-rich-quick scheme – when done properly and with a little luck, it’s a “get a little richer slowly scheme”.

With compound growth, your money can work for you.

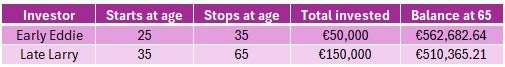

Let’s compare two investors: Early Eddie and Late Larry. Both of them decide to invest €5,000 a year at 7% annual returns, and both of them want to withdraw their cash at age 65.

The difference? Eddie starts at 25 and invests for 10 years before leaving his cash to sit and grow. Larry starts at 35 but invests for 30 years.

Here’s how it works out:

Early Eddie put in €100,000 less but has wound up with over €50,000 more.

One consideration with compound growth is how often growth or interest is applied.

Is the return annual (once a year), monthly (12 times a year), or daily (365 times a year)?

The more often interest is added, the faster money grows. Imagine you invest €10,000 at 5% return for 10 years. Here’s what you have in three different scenarios:

It’s not a gigantic difference over 10 years, but over a longer investment daily compounding can result in thousands of Euro extra.

Warning: These figures are estimates only. They are not a reliable guide to the future performance of your investment.

“Time in the market beats timing the market every time.”

Investing is a game of patience.

In other words, rather than trying to predict spikes and invest at the right time, starting early is the best strategy.

Remember the €0.01 that doubled every day? If you find an investment strategy that results in 100% daily growth you probably don’t need this guide, but hopefully that exaggerated example shows you that small investments over a long time can be extremely beneficial.

Dollar-cost averaging (or Euro-cost averaging on this side of the Atlantic) is a fancy-sounding term for a pretty straightforward investment strategy:

One of the key reasons that we should be investing in Ireland is to stop “saving ourselves poorer.”

Many people keep their extra money in the bank, credit union, or some other low-interest account that generates little to no return.

The issue with this is that while the money may be safe from the risks of a falling investment market, it is not safe from inflation.

Inflation refers to the increase in costs of goods and services over time – the recent cost-of-living crisis has thrown this into focus for many people. But even a more “normal” rate of inflation will decrease the value of your savings by a couple of percent each year.

We’ve discussed how compound growth is an incredibly powerful tool for growing money – well, inflation is the polar opposite. It’s compound anti-growth, and it can really whittle away your cash. Investments can be used to battle or potentially even outpace inflation, reducing or even negating the impact of inflation on your money.

Inflation is the enemy of compound growth

We’ve established already that the biggest ally of compound growth is time. Consistent investments, patience, and knowing just how long the long-term is will be your biggest assets.

Now let’s explore a few more strategies:

We have some other guides regarding choosing the best fund for you and finding your risk tolerance, but it’s worth considering how you might want to invest to maximise compound growth:

Time really can equal money.

Aesop wasn’t managing a Multi-Asset Portfolio of investments, but when it comes to one aspect of investment strategy his tortoise and hare story was dead on: slow and steady wins the race.

You don’t need to have a huge amount of money to invest. Even €100 a month can build some substantial wealth if things go right and you’re happy to be consistent for decades.

Err on the side of caution – a smaller amount you can invest each month is better than a larger amount you can only spare half the time.

Use a direct debit to make your investment payments on payday. That way, the money is invested without you even having to think about it.

Use round-up apps or similar tools to squirrel away extra cash each month to then invest. This is a great way to make setting money aside less effort.

One thing to note is that you should probably have your financial ducks in a row before you think about investing, especially if you want to invest more than the bare minimum. Make sure you’re free from high-interest debt and have an emergency fund built before you start your investment journey.

Warning: If you invest in this product you may lose some or all of the money you invest.

Warning: The value of your investment may go down as well as up.

Warning: These funds may be affected by changes in currency exchange rates.

Free consultation

If the idea of using compound growth to reach your financial goals appeals, then our advisors are on hand to help you.

Book an appointment virtually or in-person at a time to suit you.

Get an evaluation of your finances

Get answers to your questions

Get a free personalised plan

Get the right recommendations

“Use 60 mins to invest in your life, it’s time well spent on your future.”

- Linda Moran

Financial Advisor Irish Life

Irish Life Financial Services Limited, trading as Irish Life, is regulated by the Central Bank of Ireland. Irish Life Financial Services is an insurance intermediary tied to Irish Life Assurance for life and pensions.