If the idea of investing in an Irish Life MAPs fund appeals, then you can speak to an advisor for free about your best investment strategy.

Book an appointment virtually or in-person at a time to suit you.

by Irish Life Assurance

Written by Irish Life staff

Guides • 27 March 2025 • 7 min read

What a multi-asset investment fund is

How Irish Life Multi-Asset Portfolios (MAPs) work

Why a multi-asset fund could be your best investment

Multi asset funds are made up of a combination of asset classes, including equities, bonds and cash, and are designed with different asset allocations to create a range of low-to-high risk offerings.

Irish Life’s MAPS, or Multi-Asset Portfolios, are a range of unit linked investment available across our pension, investment, and savings plans. These funds invest in a mix of different asset classes, such as equities, bonds, property, and cash. MAPs funds aim to provide diversified investment solutions that suit different risk profiles and investment goals.

Each MAPs fund is managed to a specific risk level, designed to suit different attitudes to risk.

Irish Life’s MAPs funds are managed by Irish Life Investment Managers (ILIM). This investment firm manages funds from a wide range of companies and has done so for over 80 years – as of December 2024, ILIM manages assets worth over €131 billion.

Fund rebalancing helps mitigate risk.

Fund rebalancing is an adjustment of the split of assets in a fund, which ILIM does every three months. This means that you don’t have to worry about a fund becoming a higher risk rating than the one you originally invested in.

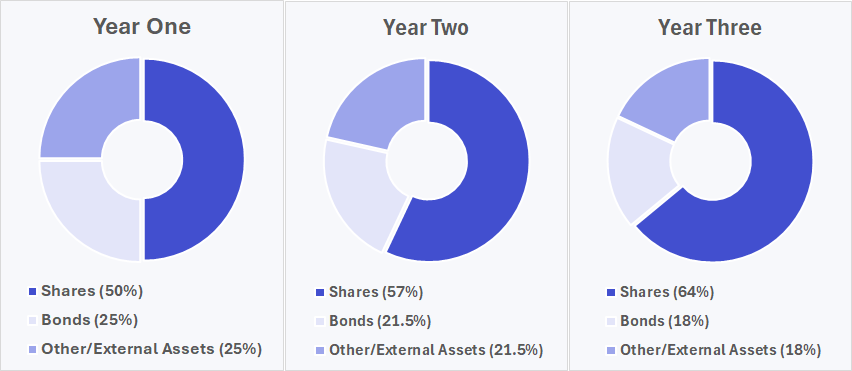

The example below shows what happens without rebalancing after three years of shares increasing by 20% and bonds and other assets falling by 10%.

Without rebalancing, investment ratios can change and may no longer be suitable for the person who chose the original allocation of 50/25/25.

ILIM avoids this change in asset split by rebalancing the fund to keep it in line with its intended split. ILIM rebalances each of the MAPs funds every quarter, which means that each fund will not drift over time.

Diversification refers to the practice of spreading your investment portfolio across different asset classes, sectors, and geographic regions. This is something that multi-asset funds do naturally.

It’s the investment form of not putting all of your eggs in one basket. If the value of one asset falls, simultaneously another might increase, lowering the risk of overall loss. You might invest in different types of assets in the hopes that it will smooth the journey, giving peace of mind in the long run.

By diversifying, investors hope to reduce the impacts of sudden market changes on their overall investment. If one particular investment performs poorly, they won't lose all of your money because they have other investments that can balance out those losses.

By diversifying, investors increase their chances of benefiting from different market cycles and economic conditions, which can help improve the chance of positive returns over the long term.

“Diversification is the investment form of not putting all of your eggs in one basket.”

The “asset” in Multi-Asset Portfolios refers to what the money is actually invested in.

Assets can be all kinds of things from art or antiques to more traditional things like shares, property, and bonds. They can be tangible (physical items) or intangible (things that don’t physically exist but still have monetary value).

Irish Life Investment Managers (ILIM) manages assets worth over €131 billion (as of December 2024) across a broad range of asset classes.

A company’s ownership is divided into shares. The value of shares can rise and fall in line with the company’s performance. The terms share, stock, and equity are often used interchangeably.

ILIM manages billions of Euro in assets.

These are loans given to various governments which are paid back at an agreed rate of interest over a set period. They’re considered to be relatively low-risk given the established nature of the governments.

These are loans to corporations or governments that agree to pay higher interest rates to compensate for added risk.

These are loans given to various companies that are paid back at an agreed rate of interest over a set period. They are considered to be riskier than government bonds due to the creditworthiness of the issuing company but also have the potential for a higher return over the long run.

These are loans given to various companies and governments in emerging markets that are paid back at an agreed rate of interest over a set period. They’re typically riskier than bonds issued by more established economies due to factors such as political instability or currency fluctuations but have higher potential to generate a bigger return with a long-term investment.

Each Irish Life MAPs fund currently has an allocation to ILIM’s Pension Property fund. The portfolio includes around 70 property assets that are leased to over 300 tenants. It also has a broad mix of commercial property. This includes offices, retail spaces and industrial properties.

Many Irish Life MAPs funds have an allocation to alternatives via external managers. Alternatives is a collective term for non-traditional asset classes as opposed to the traditional shares, bonds, property, and cash. Alternatives tend to have returns that are not correlated with traditional assets – in other words, if traditional asset values fall many alternatives see their values increase.

Warning: If you invest in this product you may lose some or all of the money you invest.

Warning: The value of your investment may go down as well as up.

Warning: These funds may be affected by changes in currency exchange rates.

Warning: Past performance is not a reliable guide to future performance.

Free consultation

If the idea of investing in an Irish Life MAPs fund appeals, then you can speak to an advisor for free about your best investment strategy.

Book an appointment virtually or in-person at a time to suit you.

Get an evaluation of your finances

Get answers to your questions

Get a free personalised plan

Get the right recommendations

“Use 60 mins to invest in your life, it’s time well spent on your future.”

- Linda Moran

Financial Advisor Irish Life

Irish Life Financial Services Limited, trading as Irish Life, is regulated by the Central Bank of Ireland. Irish Life Financial Services is an insurance intermediary tied to Irish Life Assurance for life and pensions.