Whether you're looking to refine your pension strategy with an existing company pension, or you want to set up a private pension yourself, Irish Life can help with a free advisory session at a time to suit you.

What You Really Need To Know About Company Pensions

by Irish Life Financial Services

Written by Irish Life staff

Guides • 29 July 2025 • 5 min read

What you'll learn about company pensions

How a company pension works.

The difference between defined benefit and defined contribution.

Pension strategies to boost your chances of a dream retirement.

Company pensions are quite common.

What is a company pension?

A company pension is a pension plan supplied by an employer for employees.

As opposed to a private pension, which is taken out by a person on their own behalf, a company pension (or occupational pension) is automatic for employees of the company.

Defined benefit vs defined contribution pensions

There are two types of company pensions – defined benefit and defined contribution. Both reward time with the company and are based on your salary, but they are different.

Defined benefit pensions

A defined benefit pension is common for public sector jobs in Ireland.

The figure paid at retirement is based on an employee's position on the salary scale at retirement and the number of years they have contributed to the plan. They will then receive an annual pension based on their salary and length of service.

Defined contribution pensions

This is the much more common pension plan of the two.

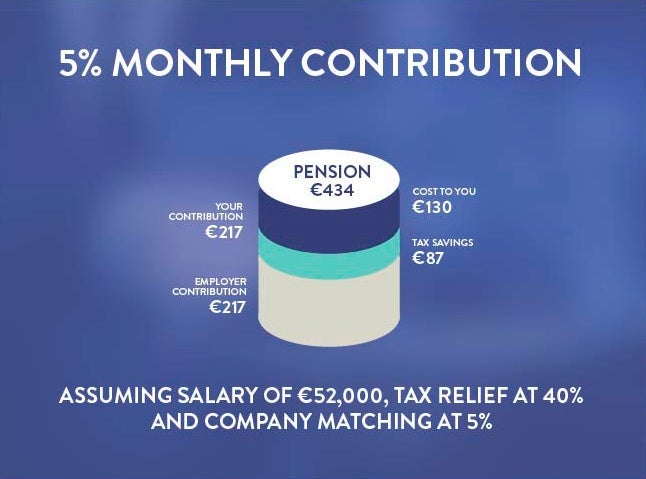

With this plan you pay a fixed amount into your pension each month (typically a percentage of your salary) and often your employer will make their own fixed contribution.

The final amount in your pension pot varies depending on how long you’ve been paying into your pension, the rate of growth your pension achieves, and how much you and your employer contribute.

If eligible, you'll get income tax relief on your contributions, though Revenue does limit this based on your age and salary.

As defined contribution pensions are much more common, we're going to explore these in more detail. If you are a member of a defined benefit plan, you can talk to your financial broker or advisor, plan sponsor or plan trustee(s) for more information.

How does a company pension plan work?

In a defined contribution pension plan, employees usually pay in a set portion of their salary, and this can be increased at any stage. The idea is to build up a fund to give you the amount you need to live on in retirement.

Generally, these contributions are taken directly via payroll before income tax is applied, though pension contributions are still subject to USC and PRSI.

Income tax saving is one of the biggest benefits of pension contributions in Ireland.

If you are a 40% taxpayer, every €100 you contribute to your pension saves you €40.

Company pensions and income tax

Many workers in Ireland are eligible for income tax relief on the contributions they make to their occupational pension.

Generally, the older you get, the more you can add to your pension without paying income tax. If you can afford it, it's a great investment to make the maximum contributions you can while still receiving income tax relief.

The percentage of your income you can contribute to a pension without paying income tax on it increases with age.

Company pension income tax relief: fast facts

You can put between 15% and 40% of your salary into your pension without paying income tax on that contribution, depending on your age.

To be eligible to claim income tax relief, your income must be taxable either Schedule E or Schedule D (case I or II).

The maximum salary amount that can be used for income tax relief is €115,000 - so if you earn more than that, only a percentage of €115,000 counts for tax purposes.

Pension payments deducted from salary will receive immediate tax relief.The self-employed must include pension contributions in their self-assessment tax returns in order to obtain income tax relief.

Can I cash in my company pension?

Generally, company pensions are designed to only be accessible when you retire.

Most people retire in their mid-sixties, but you may be able to access your pension from as young as 50 in certain circumstances - usually when you're no longer working for your employer, and the pension trustees agree to an early access.

You may also be able to early retire at any time if you are in ill health and unable ever to return to work.

It’s important to remember that if you access your pension early, the funds may not be as high as they would be if you waited until the Normal Retirement Age (NRA).

Check out our guide to retirement options and learn more about when and how you can access your pension pot.

An advisor can help with pension decisions.

What happens to my pension when I leave the company?

It all depends on what option is the best for you personally, as you have a few choices.

If you’re not sure how to proceed, it’s worth speaking to a Financial Advisor. Fill out the form at the bottom of this page and one of our friendly advisors will get in touch.

Your options when you leave a company:

How much do I need to retire in Ireland?

Ireland is not a cheap place so to live comfortably, you’re going to need a substantial amount in your pension pot. In fact, Numbeo, a database which calculates the cost of living for different countries, estimates that Ireland is the 13th most expensive place in the world to live.

You want your pension pot to be as healthy as possible and our budget planner can help determine how much you need to live on when you retire.

“Whether you’re just starting your pension or want to know how to make the most of it, Irish Life can help.”

It's important to plan your retirement income - even early on.

What will my pension be worth?

For a defined contribution pension the value of your pension will depends on how much you and your employer contribute, the rate of growth your pension fund achieves which is affected by how it is invested, and how early you start. If you have a defined benefit plan, your benefit is based on your years of service, your salary and the plan solvency.

This useful pension calculator tool can help you figure out how much and how often to contribute to your pension pot so that you can reach the end goal - the amount you need to live on in retirement.

Whether you’re starting your pension or want to know how to maximise it, Irish Life can help.

Learn more about how to make the most of your company pension and chat with a financial advisor today.

What to read next

You may also like

Free consultation

Act today - book your pensions chat

What happens in your appointment?

Get an evaluation of your finances

Get answers to your questions

Get a free personalised plan

Get the right recommendations

“Use 60 mins to invest in your life, it’s time well spent on your future.”

- Linda Moran

Financial Advisor Irish Life

Irish Life Financial Services Limited, trading as Irish Life, is regulated by the Central Bank of Ireland. Irish Life Financial Services is an insurance intermediary tied to Irish Life Assurance for life and pensions.