Getting familiar with the Smart Invest app

By Irish Life

Smart Invest was launched in 2021 by Irish Life. It offers an easy and trusted way for Irish residents to invest from as little as €100 a month. It allows you to invest in a diversified portfolio, based on your needs and managed by experts with over 80 years of experience. You can monitor your investment online or from your phone, and access comprehensive market insights and updates. Start investing today and make your savings work harder.

At the start of your journey with Smart Invest, you're asked questions to help us understand your level of comfort with risk and figure out your investor type. Then, we recommend FlexInvest plan for you. The recommendation is based on the answers you provide to match a plan with the “type” of investor you are. Smart Invest has three investor types that align with each of the three multi-asset portfolios (MAPs) funds available through our FlexInvest plan:

· Conservative

· Balanced

· Experienced

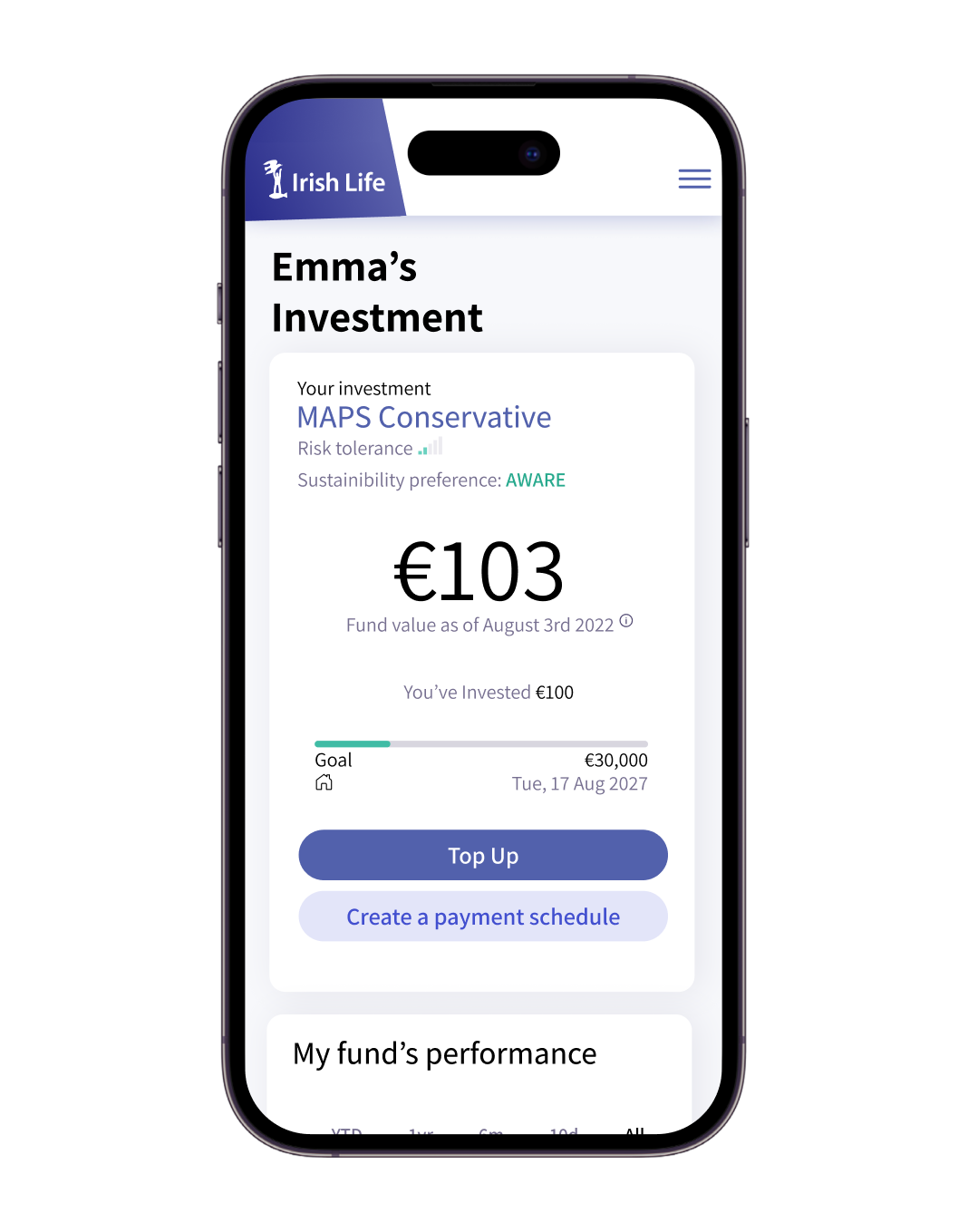

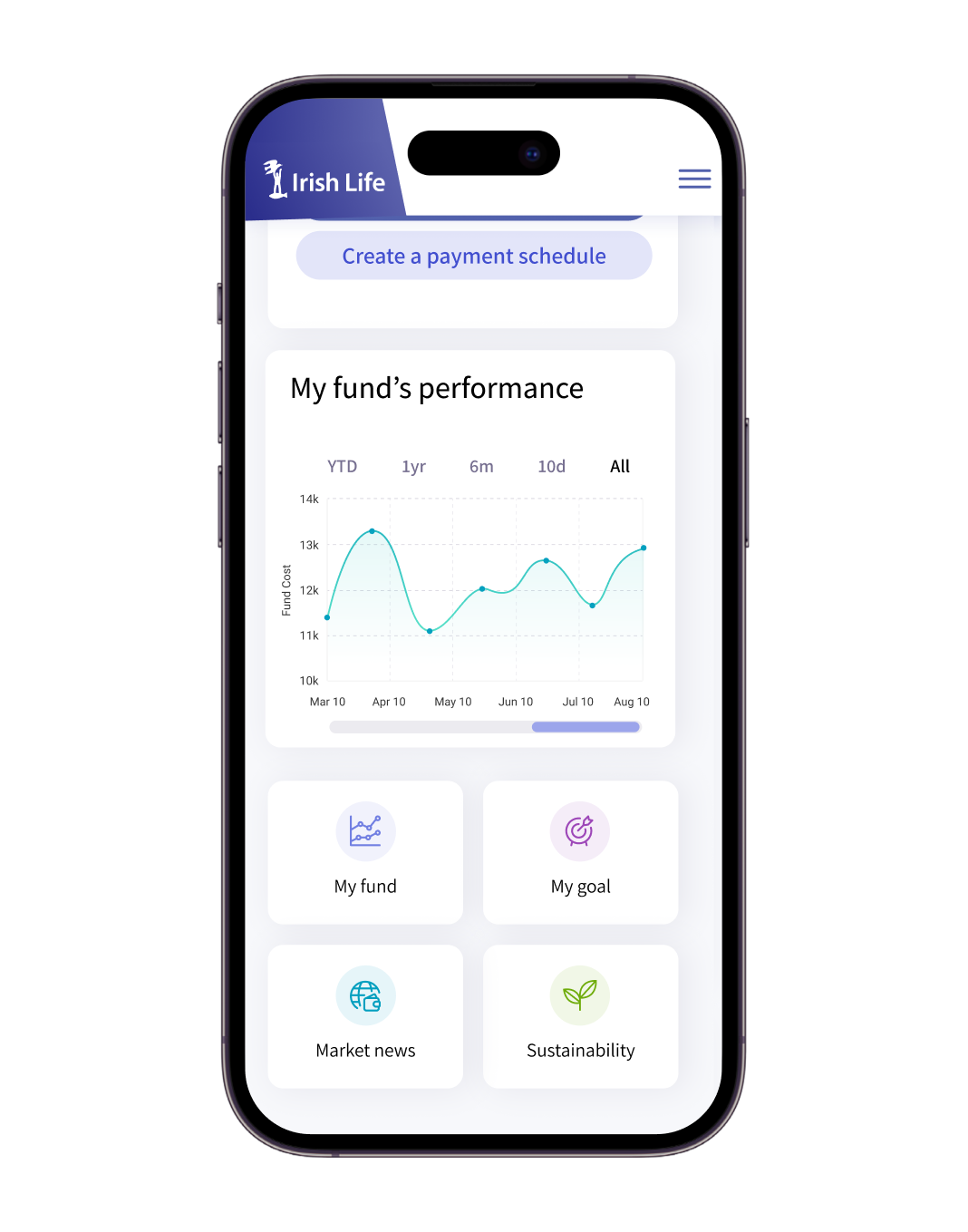

Your dashboard in the Smart Invest app will show what kind of investor you are, the level of comfort with risk you have and your sustainability preference. Your sustainability preference is shown as either “Neutral”, “Aware” or “Focused”. It reflects your answers to the questions on sustainability from the start of your Smart Invest journey. The three options relate to how you feel about the importance of the environmental and social impact of your investments.

Once you make your first investment, you can track your fund’s value from here. You can see how much you've invested and how close you are to achieving your goal. You can also easily top up your investment using a debit card, Apple Pay or Google Pay, or set up a payment schedule (see more on this below).

Your Investment

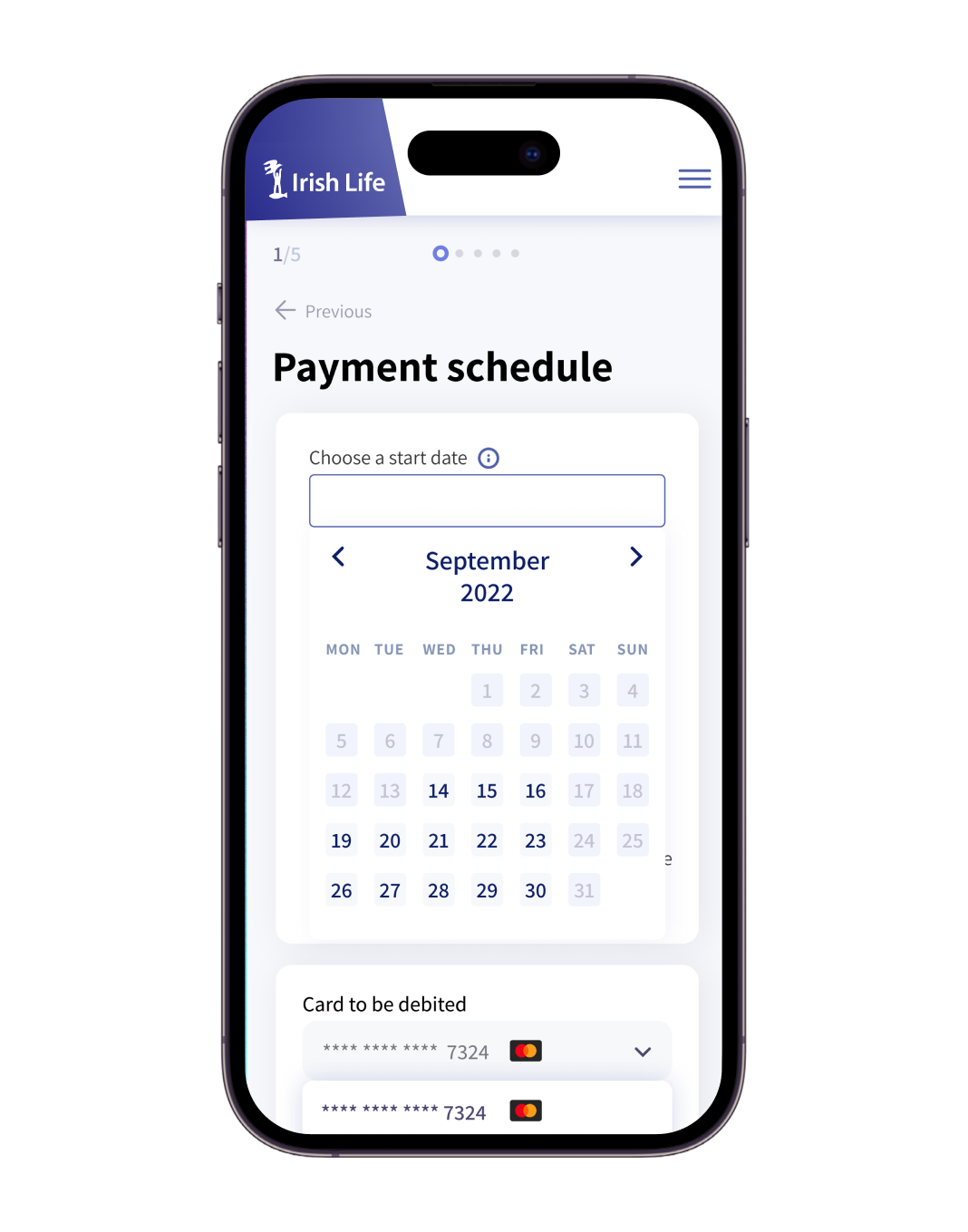

Payment Schedule

Setting up a recurring payment allows you to invest regularly. You can schedule to invest between €100 and €2,500 monthly. When setting up a recurring payment, select the start date and payment amount. You can also easily stop, change and restart your recurring payment at any time.

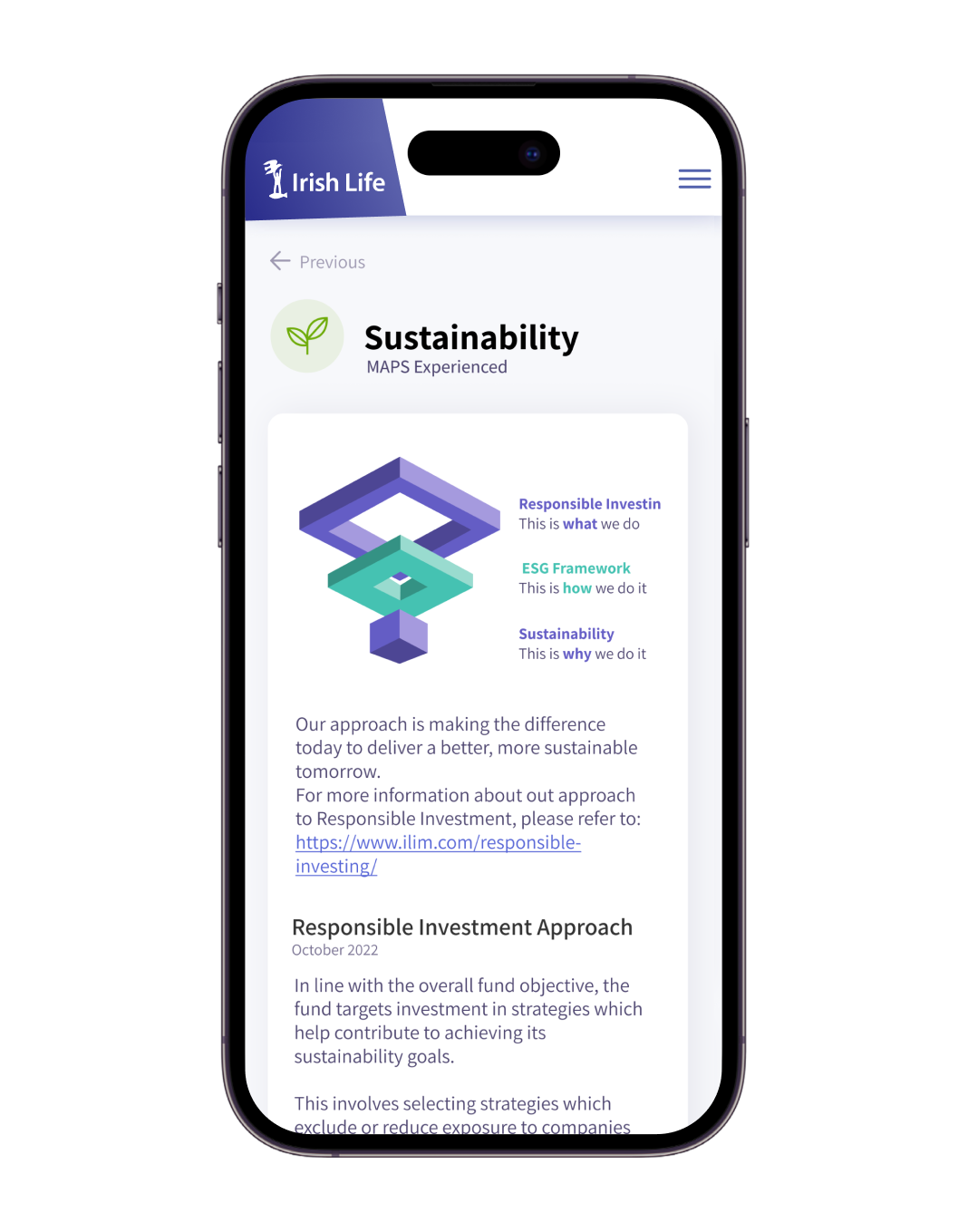

The sustainability section shows you the impact of your investment. Responsible investing aims to ensure your money isn’t harming the environment, the climate or people’s human rights. Irish Life strives to do the right thing by your money by investing less in companies that harm the planet and more in those that try to help it, all while aiming to deliver the best possible return.

Responsible investing means several things to Irish Life, like taking care of assets for the long term and making investment decisions that consider environmental, social, governance, and financial risks. In the sustainability section, you'll find further information about how Irish Life is living up to its commitment to build better futures.

Sustainability

Market News

Keeping an eye on global events helps you understand their impact on your investment. The world is more connected than ever before, and political, economic, and social developments in one country can have a ripple effect across global markets. Irish Life Investment Managers (ILIM) constantly monitors world events and adjust their strategies and portfolios to account for potential risks and opportunities.

From the Market News section of Smart Invest, you'll be able to see ILIM’s market insights and news so you’re more informed and aware of what’s impacting your investment.

This area shows a graph with the performance of the MAPs fund you're in. It’s updated daily and shows the changes in the fund’s unit prices. You can view its performance for various time periods. Markets go down as well as up, and with the Market News section, you get an insight into what events impact the fund over time.

Your fund’s performance

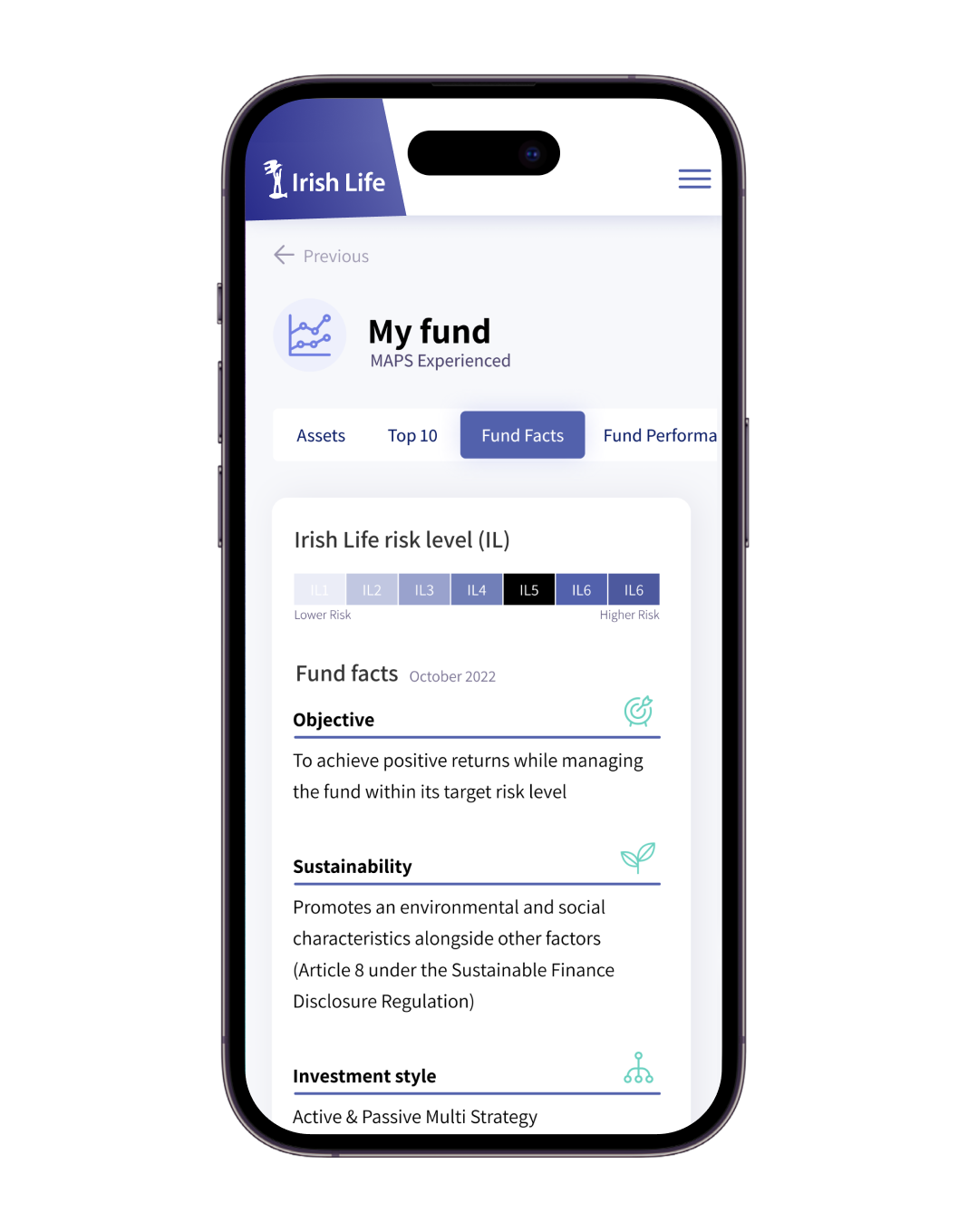

Your fund

In this section you’ll find some general information about your MAPs fund, like its objective, sustainability impact, investment style, size and the risk management strategies that ILIM uses.

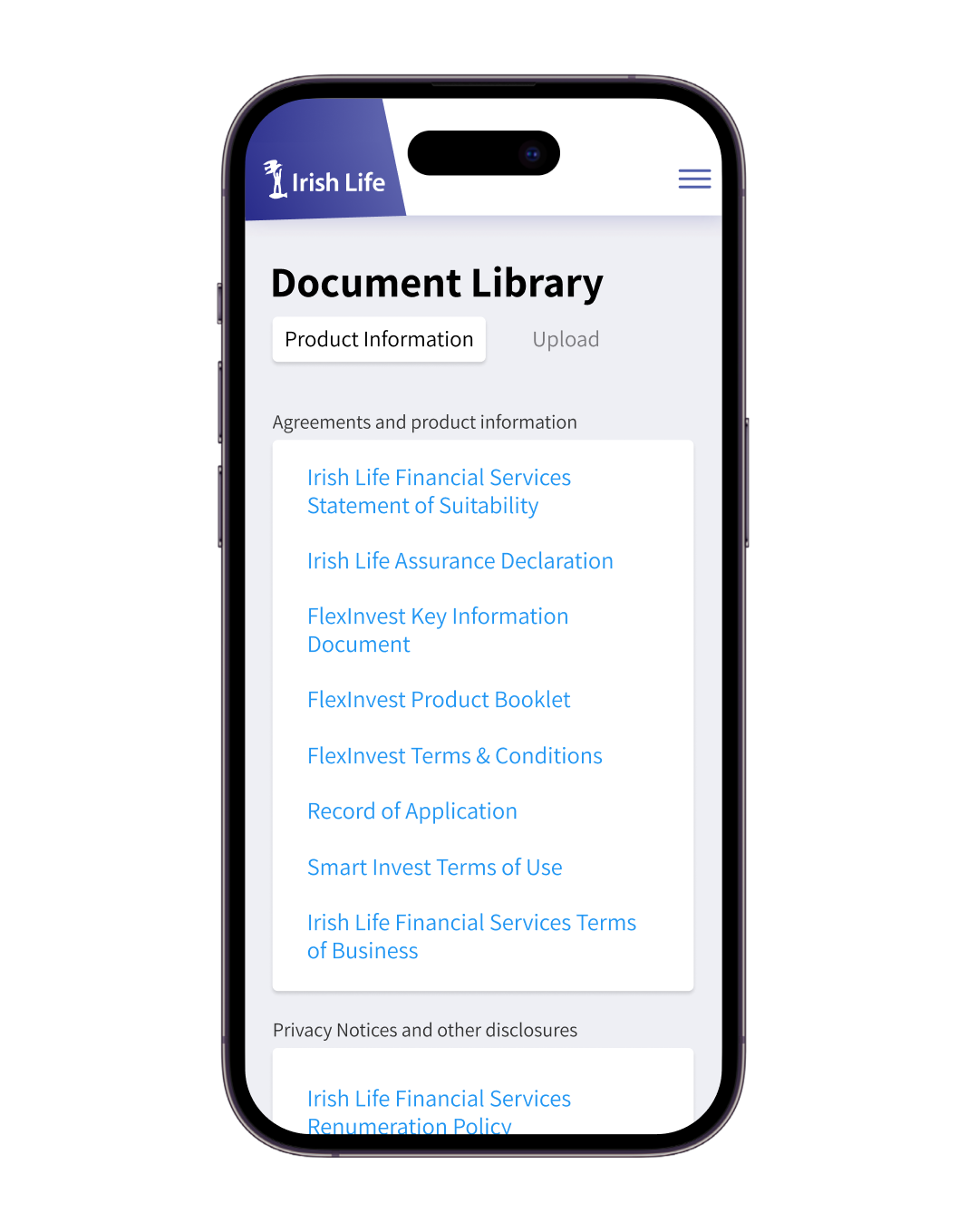

Neatly stored away in your document library, you’ll find copies off all the documents and literature that you’ll have been shown and apply to your plan. You’ll also see your welcome pack, annual benefit statements and documents confirming your top ups and the details of these. All accessed easily from the app.

Your documents