Our advisors are committed to helping people around Ireland achieve their financial goals.

Book an appointment with one of our financial advisors, virtually or in-person.

Get set up online or download the Smart Invest App. Start small with as little as €100.

You choose how much and how often you want to invest. Invest a minimum of €100 to a maximum of €10,000 at any one time. And you can increase or decrease your investment at any time.

As time goes by, inflation can chip away the value of your savings so it’s worth less over the years. Investing some of your money now could help you beat inflation and pay off in the long term. Ideally, think about the big picture and investing for 5+ years.

You don’t need to be an experienced investor. With over 80 years of expertise behind us, our appointed Investment Managers, Irish Life Investment Managers (ILM) currently manages assets of over €101 billion*. So you can rest assured knowing your investment is in experienced hands.

*Correct as of 31.03.22.

We invest in more companies and assets that promote environmental and social responsibility and good governance, which means your money is also helping to build a better, more sustainable future.

You can access your money when you need it with no penalties. Your money is transferred to your bank account within 5 days of receiving your instructions.

Your money is invested in the Irish Life Assurance FlexInvest plan, which is expertly managed by Irish Life Investment managers. FlexInvest gives you access to 1 of 3 different types of Irish Life MAP funds to suit different levels of risk, and for different possible levels of returns – Conservative, Balanced, and Experienced. So, whether you like to play it safe or are a risk taker, there’s a fund for every type of investor.

Our simple and transparent fee structure is 1.25% per year. This is made up of 1.10% management fee and 0.15% estimated average variable charge.

1% government levy will be deducted from the amount you invest.

Returns are subject to a 38% exit tax.

See key information documents and sustainability related disclosures.

Smart Invest is provided jointly by Irish Life Assurance, who provide the product, and Irish Life Financial Services, who provide the advice.

Everything that makes Smart Invest tick

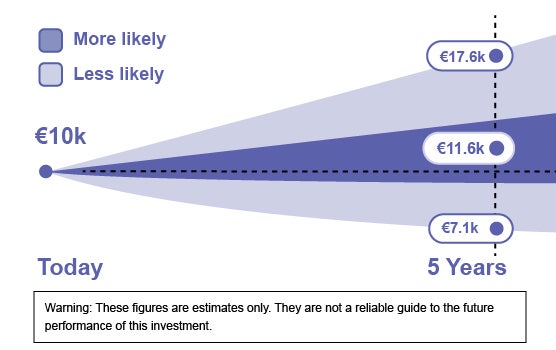

Investing can provide a range of returns, depending on the investments you make and market conditions. Let’s look at an example of a €10k investment with the Balanced Investor plan over a 5-year period*. 95% of the time the value of your investment is expected to be within the range of the blue area on the graph. This means that 5% of the time, the possible return could be higher or lower than the blue area. *Calculations by Irish Life Investment Managers and returns are calculated before fees, taxes, and charges

Smart Invest makes investing online simple and seamless, but if you have any questions then we're here to help.

Free consultation

Our advisors are committed to helping people around Ireland achieve their financial goals.

Book an appointment with one of our financial advisors, virtually or in-person.

Get an evaluation of your finances

Get answers to your questions

Get a free personalised plan

Get the right recommendations

“Use 60 mins to invest in your life, it’s time well spent on your future.”

- Linda Moran

Financial Advisor Irish Life

Irish Life Financial Services Limited, trading as Irish Life, is regulated by the Central Bank of Ireland. Irish Life Financial Services is an insurance intermediary tied to Irish Life Assurance for life and pensions.