News

Irish Life Assurance plc

3 Steps Towards Getting Financially Fit

January 4th, 2023

• 4 min read

Written by Irish Life Financial Services

If you had to list the things that are causing you stress at the moment, would money worries make the list? With the cost of living rising in Ireland, there’s never been a better time to look at your finances and ensure you’re making the most of your money. Just as you take time to look after your mental and physical wellbeing, a financial review gives you a clear picture of your overall finances, with steps you can take to improve your financial wellbeing.

Get a free financial review online now to take the first steps.

After the expense and madness of the holidays, the start of a new year is the perfect time to take control of your finances and plan for the year ahead. Read on for some easy tips to help you get financially fit.

1. Start by creating a budget

It sounds simple, but the first step to taking control of your finances is to have a clear understanding of how much money you have coming in and going out each month. Having a budget helps you make better decisions with your money so you can reach your financial goals and still be able to treat yourself. To make things easier, use this step-by-step budgeting sheet.

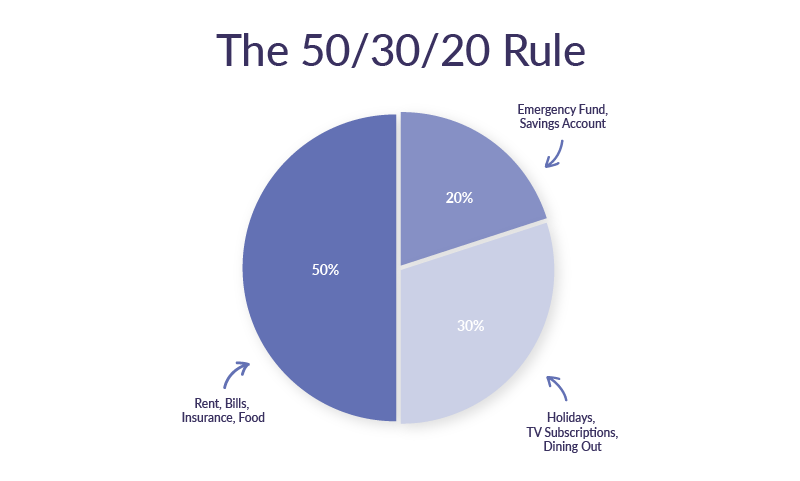

Striking the balance between spending and saving means you can enjoy going out with friends, or spending money on your hobbies, and still feel secure that you’re preparing for the future. Following the 50/30/20 rule can help. In your budget, allocate 50% of your income to the essentials – everything from rent or mortgage payments to doctor’s visits and food bills.

30% of your income is then allocated to the good stuff – your wants. Think about the non-essentials you’ve spent money on in the last month. Were you spending money out of boredom or habit, or was it worth the money to you? Working out which “wants” are worth it can help you cut out the things you buy mindlessly and spend more on the things that are worth it.

Finally, 20% of your income should be budgeted towards your future. If you don't already have an emergency fund, it’s recommended to build one up first before allocating that 20% towards other future savings. As a general rule of thumb, it’s a good idea to have three months’ salary in your emergency fund. This is your financial safety net that you can access quickly when something unexpected happens. It’s something you can dip into if you have to deal with a broken boiler, a midnight trip to the emergency vet, or unplanned car repairs.

If you already have an emergency fund in place, you could consider investing. If your money is in a savings account, it might not be keeping up with the rate of inflation. Investing gives you the chance to grow your savings and beat inflation. Read our beginner’s guide to investing to get started.

2. Set financial goals

Goals are important for focus and motivation. Setting financial goals gives you something to work towards long-term, and the motivation to reach them short-term. Your goals could be anything from saving for the house deposit to setting money aside for your children’s education in the future.

What do you want to achieve this year? Or is there a long-term goal that you can start working towards now? Setting clear goals is key to take control of your finances, whether that’s paying off your credit card or building an emergency fund.

3. Get a free financial plan from Irish Life

If you don’t have a financial plan, you’re not alone. Many people assume that financial planning is only for people who come from wealth. Or for the lotto winners who are wondering what to do with their millions after they’ve attached a waterslide to their semi-detached house.

But a financial plan simply helps you get a clear view of what to do with your money and make better decisions, whatever your income. Speaking to a financial advisor will help you assess your current financial situation, clarify your financial goals, and provide you with a custom financial plan to take the next steps.

You can book a video call with an Irish Life financial advisor below. Choose a time that suits you and get trusted financial advice from the comfort of your home. We’ll ask you for some basic information in advance and our advisor will create a personalised financial plan for you, with options and recommendations based on your needs and goals.

Afterwards, we’ll send you a copy of your complimentary financial plan to help you get started on getting financially fit.

When you’re working on improving your health and wellbeing, you know that you have to prioritise time for getting active and getting enough sleep. Consider investing time into your financial wellbeing the same way – 60 minutes today can help you learn and develop good financial habits that will reward you in the future.

Relevant articles

10 Ways to Get Fitter without Going to the Gym

What to Ask a Financial Advisor About Pensions

How To Manage Inflation and Help Protect Your Finances

How Much Money Should I Save for Retirement?

What to Ask a Financial Advisor About Life Insurance

Spend Smarter and Save More – How To Budget Your Money Monthly

6 questions everyone has about life insurance

How young is too young for a pension?

Yearly Budgeting – How to Plan for the Year Ahead

How to Budget Using the 50/30/20 Rule

Clever Ways To Save Money for Kids

The Secret Sauce: Is There a Best Way To Invest Money?

Smart financial habits worth starting today

Let's Talk

Get financial advice

Callbacks will come from Irish Life Financial Services (ILFS)

First and last name*

Phone number*

Pick a time slot

Your personal details will only be used to deal with your request. See the ILFS privacy notice for your rights and how your information is used.

Irish Life Financial Services Limited is tied to Irish Life Assurance plc for life and pensions. Irish Life Financial Services Limited is regulated by the Central Bank of Ireland.

Have a question?

Arrange a time that suits you to speak with a qualified Financial Advisor about your financial planning needs

Financial Advice Opening Hours

Mon - Thur: 9am to 5pm

Fri: 9am to 4pm