Decreasing Life Cover

from Irish Life Assurance

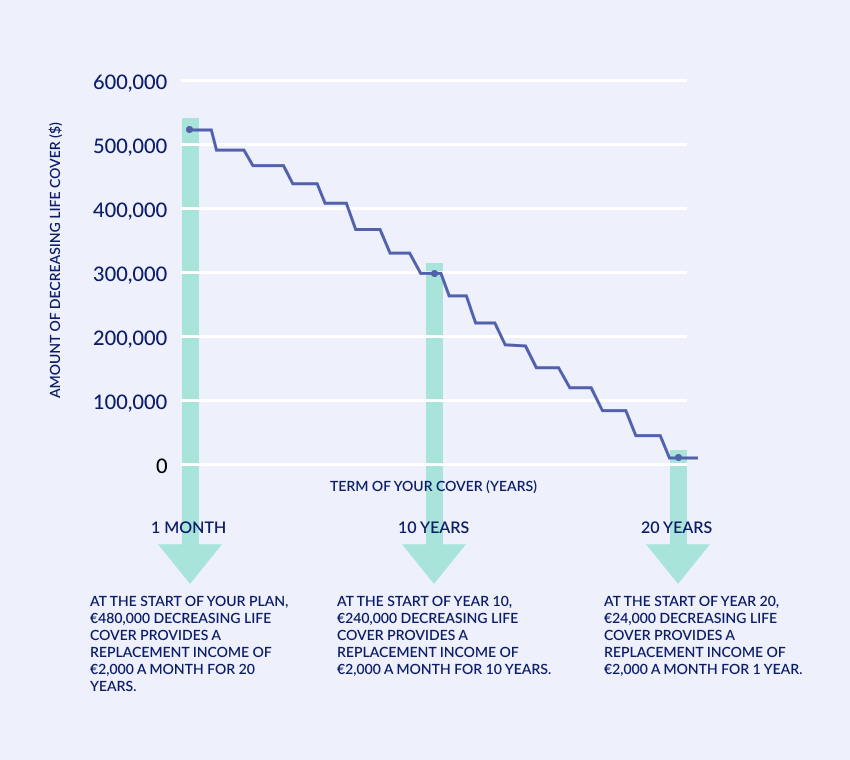

This benefit, offered under OnePlan Protection, pays a lump sum if you die during the term of the plan. Your chosen amount of cover will reduce each year. This is because the length of time you need that level of replacement income for reduces as you get older. Because the life cover amount reduces over time, the lump sum your dependants would receive if you die also reduces over time.

You can choose this benefit up to age 79.

You can be covered for up to 40 years or until age 85, whichever is earlier.

Your payments stay the same unless you change your benefits. You must keep paying to stay covered.

Decreasing Life Cover at a glance

Decreasing Life Cover Example

As an example, John, the father of a 5 year old child, earns €2,000 after tax each month. John takes out €480,000 cover for a 20 year term, protecting his family until his child turns 25. This would replace his income of €2,000 a month for 20 years. At the start of year 10, his cover has reduced to €240,000 to maintain a replacement income of €2,000 a month for the remaining 10 years of the policy.