Investments

Irish Life Financial Services Limited

Where To Invest Money in Ireland

February 28th, 2022

• 3 min read

Written by Irish Life Financial Services

Becoming an investor can sound a bit daunting. There’s all that money market jargon to master. And doesn’t being an investor require quite a lot of money?

The good news is that, no, it doesn’t! You don’t have to be the ‘Wolf of Wall Street’ to become an investor. It can be easy - we’ll show you how to become a savvy investor in no time.

Where to invest a small amount of money in Ireland

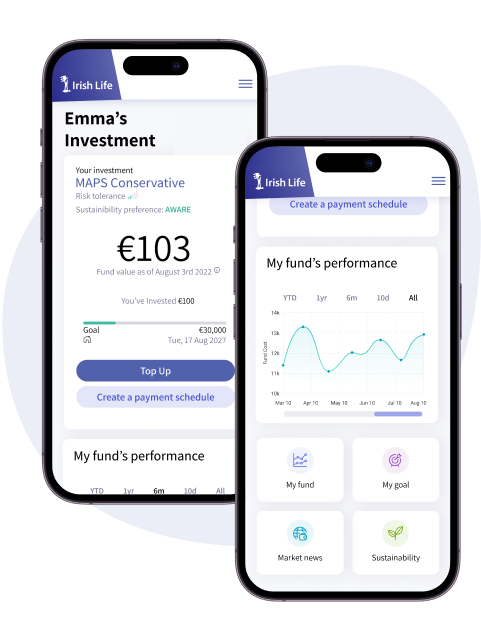

There is plenty to consider when choosing an investment product that’s right for you. But if you’re not quite ready to jump in the deep end, our new digital platform, Smart Invest, might be a good place for you to dip your toe in the investing water.

What are the benefits of Smart Invest?

As a beginner, it’s important to make sure that you feel well-informed, looked after, and supported as you start your investment journey. So we’ve created a platform for just that – and it’s all online! We think it’s pretty great. Here’s why:

Invest from €100

While not true of all managed funds in Ireland, with Smart Invest you can start investing in a FlexInvest plan from Irish Life Assurance, with just €100.

FlexInvest is a lump-sum unit-linked life insurance plan. You must be an 18-69 year old tax resident of the Republic of Ireland. You may not be a U.S. Citizen, a politically exposed person (PEP), or a relative or a close associate of a PEP. There is an annual fund management fee of 1.25%, a 1% Government levy is taken from any payments into the FlexInvest plan, and a 41% exit tax on returns.

More secure than other forms of investment

Investing involves a degree of uncertainty, otherwise known as risk. But certain types of investments are riskier than others.

Be cautious if you see promises of spectacular returns online. These are often scams - or, at best, unrealistic promises. There is no such thing as guaranteed high return investments. Unregulated investment, like buying crypto, is the lawless Wild West in comparison to regulated investment.

Regulated companies must be careful about what is promised - and about how they manage your money. Irish Life Assurance, which provides the FlexInvest product, and Irish Life Financial Services, which provides the financial advice, together provide the Smart Invest digital platform. Both are regulated by the Central Bank of Ireland.

Let an expert lead the way

It might be tempting to buy shares yourself because you have full control over choice. But these high risk investments can also be stressful, distracting, time-consuming, and ultimately can prove challenging. Do you really want to analyse the EBIT (Earnings Before Interest and Tax) of Microsoft?

It can be preferable for beginners and experienced investors alike to get the support from seasoned professionals. Through a FlexInvest plan you can get access to funds managed by Irish Life Assurance’s appointed expert investment managers from Irish Life Investment Managers who have done the diversification heavy lifting and provide built-in fund risk management.

Plus, your investment is actively monitored by investment managers who are experts in this area. They’ll manage risk when markets are scary so you have the confidence to stay invested to get those returns in the long run.

Personalised for you

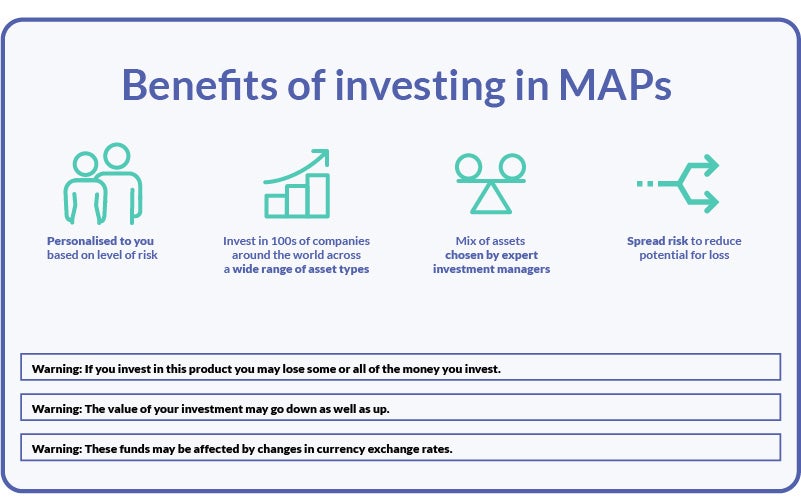

Smart Invest will guide you through learning what type of investor you are and how much risk you’re comfortable with. You’ll then be matched to a ready-made, diversified fund (the technical term = Multi Asset Portfolio (MAP)) which you can access through your FlexInvest plan.

Not caught up on your investor lingo yet? Don’t sweat it. Check out our Jargon-Busting go-to investment glossary)

Based on your investor risk profile, your money will be invested into one of 3 MAPS. Each MAP invests your money into a mix of assets such as bonds, shares, property, cash, and externally managed funds.

- MAPS Conservative Fund: More lower-risk assets like cash and bonds.

- MAPS Balanced Fund: More shares and less lower-risk assets like bonds.

- MAPS Experienced Fund: More higher risk assets and less lower risk assets.

Invest in your future today

Ready to get started? Check out Smart Invest today.

If you need some guidance before you’re ready to dive in, then it’s best to speak to a Financial Advisor who talk to you about your financial position and attitude to risk. They will then be able to recommend products suited to your needs. Or if you prefer, you could get a free financial review online now to take the first steps towards taking control of your finances.

For full information please read the FlexInvest Product Information & Terms and Conditions, and Key Information Documents.

Let's Talk

Get financial advice

Callbacks will come from Irish Life Financial Services (ILFS)

First and last name*

Phone number*

Pick a time slot

Your personal details will only be used to deal with your request. See the ILFS privacy notice for your rights and how your information is used.

Irish Life Financial Services Limited is tied to Irish Life Assurance plc for life and pensions. Irish Life Financial Services Limited is regulated by the Central Bank of Ireland.

Have a question?

Arrange a time that suits you to speak with a qualified Financial Advisor about your financial planning needs

Financial Advice Opening Hours

Mon - Thur: 9am to 5pm

Fri: 9am to 4pm